Everyone is talking about restructuring, so I am too. In my small series of in-depth articles on the SanInsFoG in general and the StaRUG in particular (see already here and here), I will now deal with the aspect of what “depth of reorganisation” the StaRUG actually stipulates (with a small, but important for future case law on the StaRUG, side glance at the InsO).

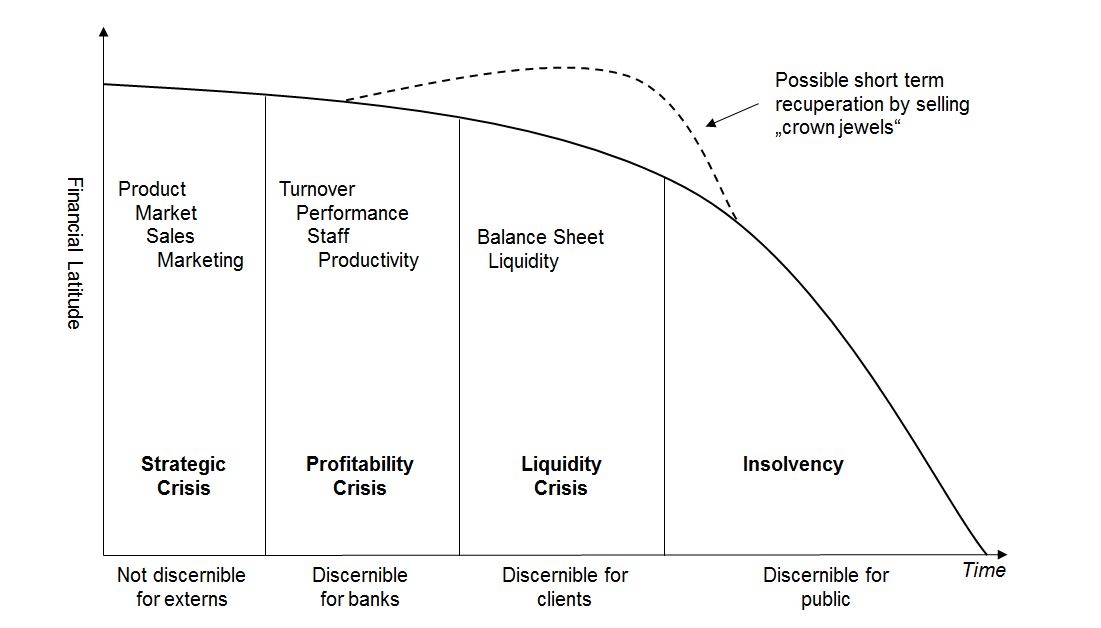

The (colloquially formulated) question of the “depth of reorganisation” serves to clarify what status a company in crisis must actually achieve in order to be considered “rescue” in the eyes of case law and literature. The German Federal Court of Justice (“Bundesgerichtshof, BGH”) leaves it at the nebulous statement that there must be a “sustainable elimination of the causes of the crisis” (cf. BGH, judgement of 12 May 2016 – IX ZR 65/14, para. 43, in German). This requirement can easily be derived graphically from the so-called “crisis progression curve”:

Accordingly, the “crisis progression curve” must be worked through “backwards”, so to speak, i.e. the insolvency, liquidity and earnings crisis must have been eliminated and strategic undesirable developments (keyword: “business model”) must have been corrected in order for a rescue / turnaround to be considered complete. Even if the formulations are not always uniform, in the literature the restructuring of a company is generally considered complete when the company formally in a crisis turns “profitable” or “competitive” again. The “restructuring standard” of the frequently cited IDW S6 defines the “ability to rescue” (“Sanierungsfähigkeit“) of a company in two stages: In the first stage, the ability to continue as a going concern must be secured and only in the second stage also “competitiveness” must be ensured (IDW S 6, margin no. 24 ff.). With reference to the aforementioned BGH ruling, the IDW requires a “restoration of the profitability of the entrepreneurial activity as a prerequisite for being able to survive in competition by one’s own efforts”.

What “depth of rescue” does the StaRUG now require? The provision of § 14 StaRUG requires that the “viability of the debtor” must be restored. While the explanatory memorandum of the government draft does not make any detailed statements on this feature, the draft bill apparently still assumes a parallelism between (insolvency law) “prognosis of continued existence” and “ability to continue as a going concern” (see Ref-E, p. 159). However, according to the prevailing view, the prognosis of continued existence does not require the (re-)establishment of the company’s earning capacity (see the attached excerpt from the Munich Commentary), even if case law repeatedly speaks of “sustainable restructuring measures”. Rather, it is “a mere solvency forecast (IDW S 11, para. 59; not so, e.g. AG Hamburg, decision of 2.12.2011, 67c IN 421/11, which constitutes a “positive earning capacity forecast”).

Accordingly, it is actually not necessary that the measures of a StaRUG restructuring plan are aimed at the sustainable business reorganisation of a business owner by working “backwards” through the complete crisis progression curve. Only the securing of solvency for the next twelve months (or 24 months, since according to § 14 StaRUG the threat of insolvency according to § 18 InsO (new) “can be eliminated by the plan”) is thus required on the basis of the legal material.

And this is not only – as shown above – a “lower” depth of restructuring compared to out-of-court restructuring, but possibly also compared to the requirements placed on an insolvency plan. For at least according to the corresponding standard for insolvency plans (IDW S2, see there para. 31), the insolvency plan must meet the requirements of IDW S6 with regard to the restoration of sustainable competitiveness. However, it is settled case law of the BGH that the insolvency court is precluded within the scope of § 231 InsO from examining whether the plan is economically expedient and whether it is likely to be successful (see only BGH, decision of 7.5.2015 – IX ZB 75/14). A further examination of the company’s material ability to continue as a going concern meets – according to the BGH (BGH, decision of 8 April 2020 – II ZB 3/19) with reference to the then RegE of the InsO, p. 90 – far-reaching systematic concerns. The insolvency court’s examination of the insolvency plan has its limits at least where it restricts the creditors’ meeting’s decision-making competence. Therefore, the insolvency court is precluded from examining whether the plan is economically expedient and whether it is likely to be successful.

Conclusion: In view of the (intended) parallelism of the restructuring plan under the StaRUG with the insolvency plan under the InsO, it is to be expected that the BGH will leave the “restructuring depth” of the plan, i.e. the decision as to whether the company must actually be geared towards a sustainable return to “profitability” or “competitiveness”, with the creditors deciding on the respective plan.

Of course, the future restructurings under the StaRUG – already against the background of the IDW standards cited here – are nevertheless likely to make corresponding forecasts for the restoration of profitability / competitiveness beyond this horizon. After all, one does not want to end up like Kettler – liquidated in the third insolvency (see only here, in German). But even the most experienced restructurer will only jump as high as the stick is held out to him. Therefore, the acceptance of a lower “restructuring depth” by the legislator, which the BGH is only following, is unfortunate. The following years after Corona will show whether this does not simply keep “zombie companies” alive.

Gesetz zur Fortentwicklung des Sanierungs- und Insolvenzrechts (Sanierungs- und Insolvenzrechtsfortentwicklungsgesetz – SanInsFoG) vom 22. Dezember 2020 (BGBl 2020, Teil I, S. 3256)

RegE eines Gesetzes zur Fortentwicklung des Sanierungs- und Insolvenzrechts (with detailed reasoning regarding the proposed legislation)

Ref-E: Gesetz zur Fortentwicklung des Sanierungs- und Insolvenzrechts (Sanierungsrechtsfortentwicklungsgesetz – SanInsFoG (with detailed reasoning regarding the proposed legislations)

RegE zur Insolvenzordnung, BT-Drs. 12/2443

All in German